Table Of Content

Check out our list of first-time home buyer programs, grants and mortgage loan options to see how you qualify. Explore different home-buying costs, like the down payment and closing costs, to determine how much money you need to buy a house. Down payment requirements for a primary (main) residence will vary. The requirements will depend on the type of loan you’re applying for and your financial situation.

Best Lenders for Low- and No-Down-Payment Mortgages of 2024

Keep in mind that there’s no right or wrong answer for how much you need to have as a down payment to buy a house. In general, the younger a buyer is, the more likely they are to make a smaller down payment. A second home is a residence you occupy in addition to your primary residence. The property can be a vacation home or a home you visit regularly.

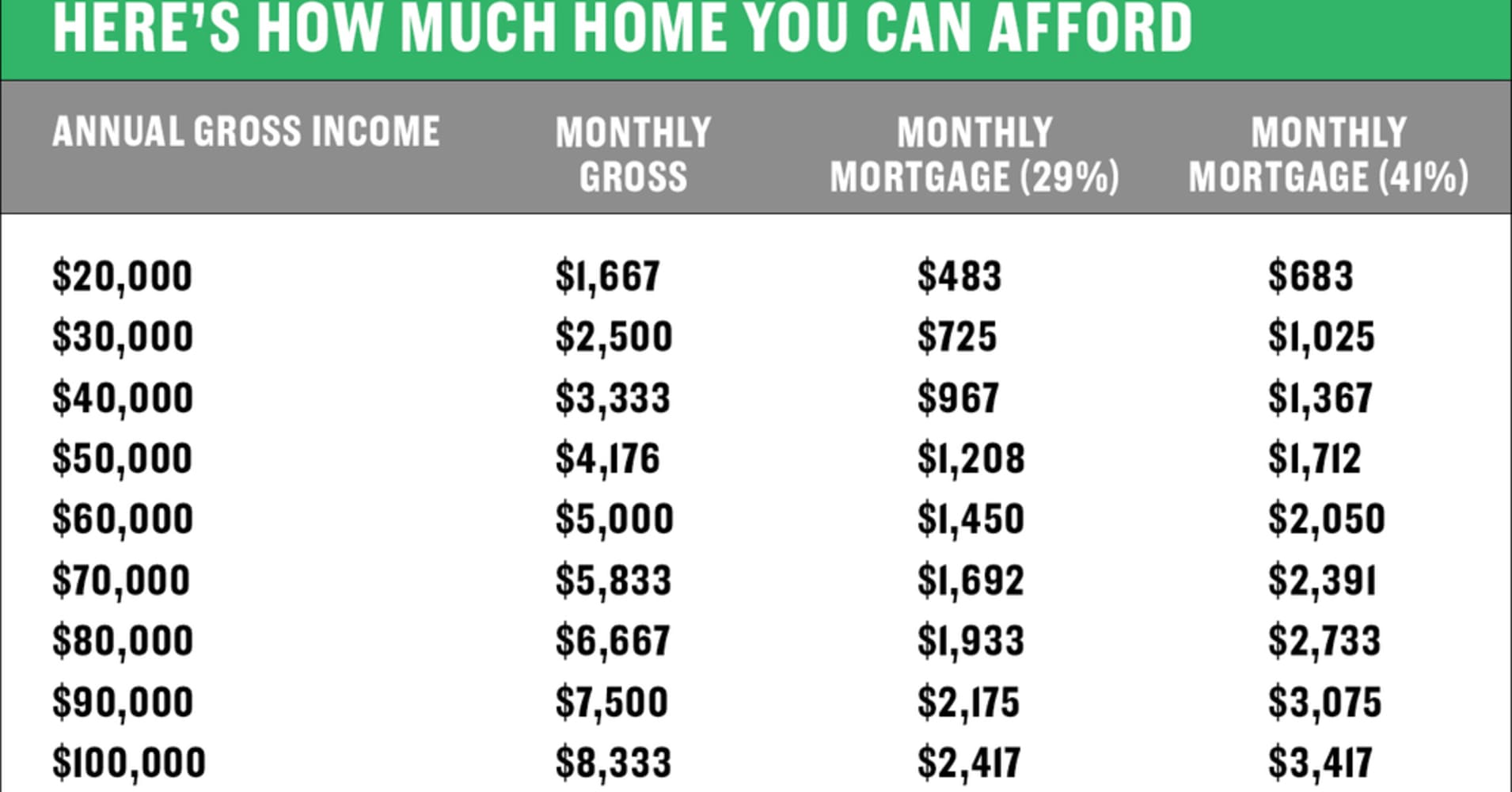

How much house can I afford based on my salary?

It can be challenging to save the money for a down payment on a house, especially if you’re a first-time homebuyer. The standard minimum down payments for various types of mortgages might not be as high as you think, however. Here’s what to know about the average down payment on a house for a first-time buyer. Take account of your financial readiness to buy a house by applying the 28/36 rule. Lenders generally want to see that when you add up your principal, interest, taxes and insurance, it totals less than 28% of your gross monthly income.

How We Make Money

This is due to the fact that a larger down payment lowers the lender’s risk because the borrower has more equity in the home from the beginning. There are many home buyer assistance programs available through state and local governments. Participating charities also offer financial aid to eligible home buyers. Many lenders recommend a DTI below 43%, but some programs allow a maximum of 50%. Additionally, having a good credit score of 670 or above helps you qualify for lower rates and fees, as lenders perceive less risk.

Earnest Money: What Is It And How Much Is Enough?

If you owe $200,000 on your mortgage and your home is worth $300,000, then your equity is $100,000. The good news is that you can buy a house with less than 20% down though it is a good idea to put down as much as you can. Here are some of the considerations when thinking about how much of a down payment you may need for your dream house. Victoria Araj is a Section Editor for Rocket Mortgage and held roles in mortgage banking, public relations and more in her 15+ years with the company.

The foundation for a custom California home will cost anywhere from $1,300 to $20,000, bringing the typical cost to around $10,650. The final cost of the foundation will depend on the slope grade, as California isn’t known for flat land. Houses in California are typically built on a slab foundation, and the cost to build a basement is higher than in most places, with prices of up to $50,000. The average construction manager for homes under $10 million will charge 5% to 15% of the project total.

How Much Income & Down Payment is Needed for a $500k Home? - TAPinto.net

How Much Income & Down Payment is Needed for a $500k Home?.

Posted: Fri, 01 Sep 2023 07:00:00 GMT [source]

That $85,000 difference will make your mortgage much more expensive if you’re paying 7% or 8% (or whatever the mortgage rate you can get when you buy) for 30 years. Well, we already mentioned that you’ll often be in line for a lower mortgage rate. They’re available only to people on moderate and low incomes who are buying in an area that the USDA counts as rural. So, let’s next dig into those homeownership eligibility hurdles and the minimum down payment for different types of mortgages.

With this being a new home, you'll need to go based on approximation since you don’t know how much electricity you'll be using. Generally speaking, you'll save money by buying an existing home, around $150,000. This may mean not getting exactly what you want, but you'll be able to move in quicker versus the average time of seven months it takes to construct a new home. In addition, you may have less stress over the construction process. The job loss means that Charlie is unable to get final approval for a mortgage and withdraws their offer. Because there were no contingencies in place, Charlie is required to forfeit their earnest money deposit.

Pros Of A 20% Down Payment

In the second quarter of 2023, Louisiana home buyers made the lowest average down payment of 9.2% at $6,729, while Washington, D.C. Has the highest down payment percentage amount at 20.4%, with a $100,800 median down payment due to the area’s expensive housing market. A higher down payment helps reduce your monthly mortgage payments, which can keep your DTI at a reasonable level. As noted earlier, the typical down payment for first-time home buyers in America is about 6% of the purchase price. However, buying a home with as little as zero down is possible for USDA and VA borrowers, and others can put as little as 3% or 3.5% down. Many borrowers put down more than the minimum, either through savings, gifts or down payment assistance.

In a hot real estate market, some buyers feel pressure to waive contingencies; for instance, they may consider this if they're absolutely certain they'll qualify for a mortgage. However, it's never a good idea to waive the appraisal or inspection contingencies. If you're working with a real estate agent, they should be able to provide direction on how much earnest money you should offer. Suppose you put down a significant chunk (20%) of the down payment needed for a $500K house. But if you make a 3% down payment, you’ll be borrowing $485,000. The size of the down payment you need will depend on the type of mortgage you choose and your financial situation.

If the buyer has a change of heart and the seller will keep the earnest money, lay that out as well. If you weren't preapproved for a mortgage when you put your earnest money deposit down – or even if you were – and then you don't get approved, a mortgage contingency can protect you. The finance contingency gives you the right to walk away and get your earnest money back as long as this contingency is listed in the agreement. If you don't want to back out of the deal, you could also work with the seller to have the repairs made or have them lower the purchase price so you can do the repairs yourself.

No comments:

Post a Comment